Hope all is fine and you have no

outstanding from the Shardha Group of Cheating Companies. If yes than,

my heartfelt condolences. Although the West Bengal politicians want that

the residents of the state to smoke more (strong contender for case study at London school of Economics) and pay for lapses but all said and done it will be a long process by which you can get a part of your investment back.

One bad decision, one bad advice, one bad selection and one bad result.

These so called investment avenues called by legal names and working

under the legal framework of Collective Investment Schemes” such as Chit

Funds, Multi-level Marketing or Deposit Raising companies have eroded

the common man’s wealth and then also people fall prey… again and again.

Why does a scheme defaults?

1) It is made to cheat and siphon

off money from general public. The promoters of the company have no

business plan but they know that if they can mock a business plan they

can get investors and then they can exit taking cash and other assets.

2) The company started with a plan

but could not settle and planning failed. Promoters do not want to

accept failure or they have their credibility, brand or other business

at stake so they do not consider winding up legally instead prolong the

affairs by window dressing books, media play and false commitments.

The type 2 is easy to know as they are

established companies going a down fall. The information regarding these

companies is wide spread as they have been operating for good amount of

time. Sometime these companies have sister concerns listed in stock

exchanges and the financial data is known to general public. By studying

these data and a bit a research from market experts can be helpful to

know about the real motives of the promoters.

How to identify a Runaway Bride?

It is tough to identify the type 1

companies. Although difficult but there are few ways and parameters to

identify a scheme which is going to default or run away. These ways are:

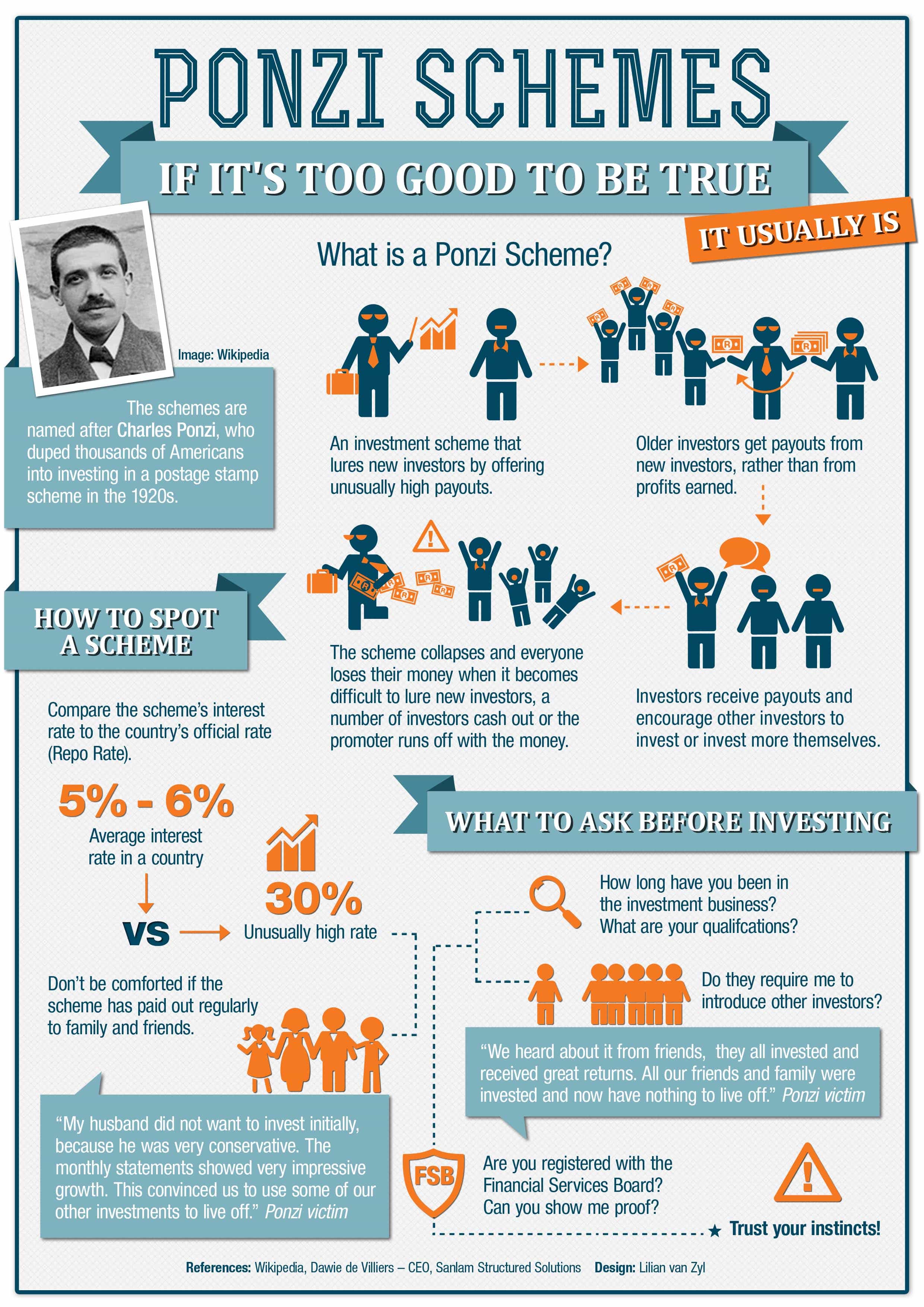

1) Over the market returns:

These companies offer over the market returns. Returns act as stimulus to greed. You offer a rate which is 4-5 % of bank fixed deposit

rate, people find it attractive. Even the retiring uncle will be tempt

to put 20% of his retirement kitty in these companies, explaining

himself that the company won’t run and even if it runs away I will be

ruined by 20% of net worth only and that will be a god willing event.

Just ask question to yourself that when Banks are flooded with

liquidity, why doesn’t the company take a bank loan and pay interest

which will be less in comparisons to what they paying to public. The

reason is simple that bank has access to financial information and

credit worthiness of the company and they are not willing to take a risk. But public has high appetite of risk. Isn’t it.

2) Over the market middleman’s commission:

These companies offer very lucrative

commission ranging from 2-6% as per target achievement. The agents also

get freebies like holidays on resorts, vehicles like cycles to car,

gadgets and achievement awards nights (read: free alcohol drenched

parties often presided by Bollywood’s B grade actresses, handing over

shining trophies). Also in rural areas normally an influential person

like teacher or village headman is appointed as agent so that people get

influenced by the person also.

3) Business Plan:

These companies normally do not have a

business plan or may have one or two unit operating on small scale to

cover up for the existing business. An upcoming hotel & resort

chain, a media house, a precious commodity which only few can bring

underneath the land, a thousand of acre of land near Mumbai, sudden

demand of some green herb in US or Europe are some examples of the

business objective that are displayed in general public. The idea will

be that the line of business will have low awareness, so most people

believe what is told since they lack questions and facts. Sometime play

is made around cost also that company is making and X product in 50

percent less cost in comparison to competition hence benefit is passed

to the stakeholders. As Warren Buffett said, do not invest what you

don’t understand. Stick to this basic rule.

4) Strong nonexistence guarantees:

When an investor question the risks involved the agent or the company lay false guarantees in form of cash reserve, gold

reserves or the land bank in the name of the company. They make the

size of your investment to peanuts and make you believe that company has

lakhs of depositors investing crores of rupees and they are paying each

one of them since so many years. Guarantees are often perceived

guarantees when celebrities are brought (read: bought) in to inaugurate

the company offices. Respected people or politicians are used as board

members or called chief guest in functions. The brochure and wall of the

company offices will full of such photographs specially clicked for

these purposes.

5) Dubious in where about:

When you ask about the company office

the first response is that company has offices in every main city of the

country. The address provide are either nonexistent or belong to group

companies. The real promoters do not come in open very often and let key

employees handle the affairs. There addresses and verifications are

usually wrong and sometimes foreign addresses are provided so that it

becomes difficult to trace. Even the assets which company says belong to

them are not specified. The promoters also may have shoddy past and

seem to be changing business very frequently. After Shraddha instance,

my eyes too blinked when I came to know that promoter’s father also ran

same kind of cheating business and to avoid connection he went for a

plastic surgery!

6) Modus operandi:

The business starts with full fanfare.

No stone is left unturned- glossy brochures, website, employees all

things are lined up. Initial investors and agents are rewarded in

ceremonies. The big cheques of interests and commissions are paid in

front of media to establish a brand. Big advertisements appear to

appoint agents and franchisees. Company pays dues for few years through

the Ponzi mechanism and they wait till the debt book swells to millions.

Then all of sudden the cheques are dispatched late, then they are

dishonored by the banks for insufficient payments. And before media and

public make noise, the promoters get themselves under ground or leave

India. Agents surround offices to shift blame of their foolishness and

greed on company only. The investor as usual cribs on his luck (not on

his irrationality and ignorance). Finally the lawmen arrives and a long

legal battle starts to get the money back, or at least a part of it.

Returns are dependent on Risk taken.

But is the risk of this nature worth to be taken to earn a some more returns?

~

Source : tflguide

No comments:

Post a Comment